Commercial Bank in India - Definition,Functions & Types

A commercial bank is a kind of financial institution that carries all the operations related to deposit and withdrawal of money for the general public, providing loans for investment, and other such activities. These banks are profit-making institutions and do business only to make a profit.

Table of Contents

Toggle- The two primary characteristics of a commercial bank are lending and borrowing. The bank receives the deposits and gives money to various projects to earn interest (profit). The rate of interest that a bank offers to the depositors is known as the borrowing rate, while the rate at which a bank lends money is known as the lending rate.

- Commercial banks are regulated by the Banking Regulation Act 1949. Commercial Banks operate with a head office and network of branch offices spread throughout the country. Commercial banks are one of the types of banks in India.

- The main functions of commercial banks are: to accept deposits from the public and grant loans to individuals, traders, and industries at a defined rate of interest in order to earn profit and to offer other basic financial services to business organizations.

- They also provide other services like remittance of funds, locker facility, collection of cheques, issue letter of credit, bank guarantees, business loans, cash credit limit facility, overdraft facilities, purchase and sale of bonds and securities, etc.

What is the first commercial bank of India?

Bank of Calcutta is the oldest commercial bank in India. It was established in the year 1806. It was later renamed the Bank of Bengal. Currently it is known as State Bank of India.

Function of Commercial Bank

The functions of commercial banks are classified into two main divisions.

(a) Primary functions

i) Accepts deposit : The bank takes deposits in the form of saving, current, and fixed deposits. The surplus balances collected from the firm and individuals are lent to the temporary requirements of the commercial transactions.

ii) Provides loan and advances : Another critical function of this bank is to offer loans and advances to the entrepreneurs and business people, and collect interest. For every bank, it is the primary source of making profits. In this process, a bank retains a small number of deposits as a reserve and offers (lends) the remaining amount to the borrowers in demand loans, overdraft, cash credit, short-run loans, and more such banks.

iii) Credit cash: When a customer is provided with credit or loan, they are not provided with liquid cash. First, a bank account is opened for the customer and then the money is transferred to the account. This process allows the bank to create money.

(b) Secondary functions

i) Discounting bills of exchange: It is a written agreement acknowledging the amount of money to be paid against the goods purchased at a given point of time in the future. The amount can also be cleared before the quoted time through a discounting method of a commercial bank.

ii) Overdraft facility: It is an advance given to a customer by keeping the current account to overdraw up to the given limit.

iii) Purchasing and selling of the securities: The bank offers you with the facility of selling and buying the securities.

iv) Locker facilities: A bank provides locker facilities to the customers to keep their valuables or documents safely. The banks charge a minimum of an annual fee for this service.

v) Paying and gathering the credit : It uses different instruments like a promissory note, cheques, and bill of exchange.

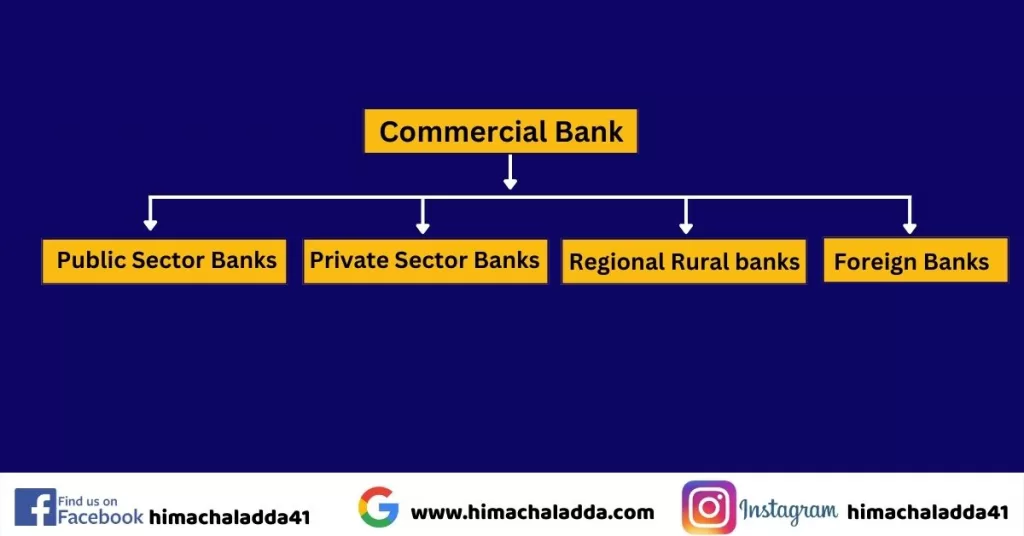

Types of Commercial Bank

Commercial banks are divided into:

- Public Sector Banks

- Private Sector Banks.

- Regional Rural banks.

- Foreign Banks

1) Public sector bank

- Public sector banks Refer to a type of commercial banks that are nationalized by the government of a country. In public sector banks, the major stake is held by the government. In India, public sector banks operate under the guidelines of Reserve Bank of India (RBI), which is the central bank.

- Public Sector Banks (PSBs) are a major type of government owned banks in India, where a majority stake (i.e. more than 50%) is held by the Ministry of Finance of the Government of India or State Ministry of Finance of various State Governments of India. The shares of these banks are listed on stock exchanges. Their main objective is social welfare.

- Public sector banks are those banks where the government holds more than 50% ownership. With these banks, the government regulates the financial guidelines. Because of government ownership, most depositors believe that their money is more secured in public sector banks. As a result, most public sector banks have a large customer base.

For example, The State bank of India (SBI) is the largest public sector bank in India. In this bank, the Indian government holds more than 57.2% share. A large part of the remaining share is also traded in the Indian stock market.

Public sector banks are nationalized banks.

There are 12 public sector banks as of 2022, but earlier, there are 27 banks that have now been merged.

Below is the list of all the public sector banks along with some important information about them

List of Public sector bank

Name of Bank | Merged Bank | Government Shareholding | Established Year |

Bank of Baroda | 1) Vijaya Bank

2) Dena Bank | 71.60% | 1908 |

Bank of India | - | 89.10% | 1906 |

Bank of Maharashtra | - | 92.49% | 1935 |

Canara Bank | Syndicate Bank | 78.52% | 1906 |

Central Bank of India | - | 92.39% | 1911 |

Indian Bank | Allahabad Bank | 88.06% | 1907 |

Indian Overseas Bank | - | 95.84% | 1937 |

Punjab and Sind Bank | - | 83.06% | 1908 |

Punjab National Bank | 1) Oriental Bank of Commerce 2) United Bank of India | 85.59% | 1894 |

State Bank of India | 1) State Bank of Bikaner & Jaipur 2) State Bank of Hyderabad 3) State Bank of Indore 4)State Bank of Mysore 6 )State Bank of Saurashtra 7) State Bank of Travancore 8)Bhartiya Mahila Bank | 57.2% | 1955 |

UCO Bank | - | 94.44% | 1943 |

Union Bank of India | 1) Andhra Bank 2) Corporation Bank | 89.07% | 1919 |

2) Private Sector Banks

- Banks in which a major stake or equity is held by private shareholders. All the banking rules and regulations laid down by the RBI will be applicable to private sector banks as well.

- When the economic reforms were taking place in the early nineties the role of private banks was recognized.

- Financial sector reforms were set up in the year, 1991 under Shri M. Narasimham Committee.

- From the year 1993 to the year, 2020 RBI issued banking licenses to different types of banks in India.

- In the year, 1993 the initial minimum paid-up capital was raised from ₹100 crores to ₹200 crores, which was required to be raised further to ₹300 crores within three years of commencement of business.

- The objective of financial reforms and providing licenses to the private banks in the year,1991 was to bring competition and efficiency to the banking industry.

Given below is the list of private-sector banks in India – 21 private sector banks in India (till august 2022)

List of Private sector bank

Name of Bank | Headquarter | Established Year |

Axis Bank | Mumbai | 1993 |

Bandhan Bank | Kolkata | 2015 |

CSB Bank | Thrissur, Kerala | 1920 |

City Union Bank | Thanjavur, Tamil Nadu | 1904 |

DCB Bank | Mumbai, Maharashtra | 1930 |

Dhanlaxmi Bank | Thrissur, Kerala | 1927 |

Federal Bank | Aluva, Kerala | 1931 |

HDFC Bank | Mumbai, Maharashtra | 1994 |

ICICI Bank | Mumbai, Maharashtra | 1994 |

IndusInd Bank | Mumbai, Maharashtra | 1964 |

IDFC FIRST Bank | Mumbai, Maharashtra | 2015 |

Jammu & Kashmir Bank | Srinagar, J&K | 1938 |

Karnataka Bank | Mangaluru, Karnataka | 1924 |

Karur Vysya Bank | Karur, Tamil Nadu | 1916 |

Kotak Mahindra Bank | Mumbai, Maharashtra | 2003 |

IDBI Bank | Mumbai, Maharashtra | 1964 |

Nainital bank | Nainital, Uttarakhand | 1922 |

RBL Bank | Mumbai, Maharashtra | 1943 |

South Indian Bank | Thrissur, Kerala | 1929 |

Tamilnad Mercantile Bank | Thoothukudi, Tamil Nadu | 1921 |

YES Bank | Mumbai, Maharashtra | 2004 |

3) Regional Rural Bank

Regional Rural Banks (RRBs) are government owned scheduled commercial banks of India that operate at regional level in different states of India. These banks are under the ownership of Ministry of Finance , Government of India. They were created to serve rural areas with basic banking and financial services. However, RRBs also have urban branches.

The area of operation is limited to the area notified by the government of India covering, and it covers one or more districts in the State. RRBs perform various functions such as providing banking facilities to rural and semi-urban areas, carrying out government operations like disbursement of wages of MGNREGA workers and distribution of pensions, providing para-banking facilities like locker facilities, debit and credit cards, mobile banking, internet banking, and UPI services.

Functions of Regional Rural Banks (RRBs):

Regional Rural Banks are local level banking operations in all states of India. They have been created with a view to serve primarily the rural areas of the country with basic banking and financial services. However, Regional Rural Bank may have branches set up for urban operations and their area of operation may include urban areas too.

The Regional Rural Banks are required to function within a limited area for which they are established. Usually the functional area of Each RRB is confined to a few districts of the state in which they are set up. The area of functioning of RRBs is decided by central government in consultation with NABARD and the Sponsor Banks by way of a notification issued in this regard.

Main objective of Regional Rural Banks:

- Providing banking facilities to rural and semi-urban areas.

- Distribution of pensions, carrying out government operations like disbursement of wages of MGNREGA workers and etc.

- Providing Para-Banking facilities like locker facilities, debit and credit cards.

- To save the rural poor people from the moneylenders.

- To increase employment opportunities by encouraging trade and commerce in rural areas.

- To encourage entrepreneurship in rural areas.

Ownership of RRBs:

Each Regional Rural Bank is sponsored by a Public Sector Bank. A sponsor bank in relation to a Regional Rural Bank is a Bank by which such a RRB is sponsored. It is duty of a sponsor bank to aid and assist the RRB sponsored by it.

A sponsor bank helps RRB by:

a) Subscribing to the share capital.

b) Training personnel of Regional Rural Bank.

c) Providing managerial and financial assistance to RRB.

A sponsor bank provides such managerial (staff) and financial assistance during the first 5 years of its functioning. The central government may, either on its own motion or on the recommendations of NABARD extend such period of 5 years for such further period(not exceeding 5 years at a time) as may be deemed fit.

The authorized capital of Regional Rural Banks is Rs. 5 crores which is contributed by Central Government, State Government and the Sponsor Bank in ratio of 50:15:35.

The equity of RRBs is held by the stakeholders in fixed proportions of 50:15:35 distributed among the following –

Central Government has 50% share.

State Government has 15% share.

The Sponsor Bank has 35% share.

4) Foreign Banks

Foreign banks are registered and have their headquarters in another country, but they have branches in our country. A foreign bank branch is a type of foreign bank that is required to follow both the home and host country’s regulations. Banks frequently open a foreign branch in order to better serve their multinational corporate clients.

- Currently, there are 45 foreign banks operating in the form of foreign bank branches and 34 foreign banks operating in the form of representative offices.

- Foreign banks are supposed to provide banking services to multinational clients, industries, corporates, etc.

- A bank that has to follow a dual banking regulation system in a country is known as a foreign bank.

- These banks follow the regulations of their home country as well as the country in which they are operating.

- Such types of banks in India have their headquarters in a foreign country but operate in India.

- Foreign banks have presence in India with 2 models. Either through branches or Wholly Owned Subsidiaries.

- The initial minimum paid-up equity capital shall be 5 billion.

Standard Chartered Bank (United Kingdom) has most highest number of branches in india compare to other foreign bank(it has 100 branches in India).Some other foreign banks are J.P. Morgan Chase Bank N.A.(USA)(4 branches),HSBC Ltd-Hong Kong (26 branches), Citibank N.A.-USA (35 branches) etc.